Biocon Q1FY26 Operating Revenue at Rs 3,942 Cr, Up 15%

-

Thu, 07-Aug-2025

- Posted by: BIOCON

EBITDA at Rs 829 Cr; Up 19%*;

Bengaluru, Karnataka, India: Aug 7, 2025:

Biocon Limited (BSE code: 532523, NSE: BIOCON), an innovation-led global biopharmaceuticals company, today announced its consolidated financial results for the fiscal first quarter ended June 30, 2025.

Leadership Comments

BIOCON GROUP

“Biocon opened FY26 with a strong performance, driven by continued gains in Biosimilars and CRDMO, and a steady showing in Generics. Operating Revenue rose 15% YoY to Rs 3,942 crore, with EBITDA up 19% on a like-for-like basis, demonstrating operating leverage and the robustness of our businesses.

The recent QIP has strengthened our balance sheet and enables us to increase our ownership in Biocon Biologics by facilitating the exit of structured equity investors, aligning capital structure with long-term strategic priorities.

Key developments this quarter include the launch of Yesafili™ in Canada, our tenth biosimilar globally, and USFDA approval for Insulin Aspart, our second interchangeable biosimilar Insulin, further deepening our presence in the U.S. insulin market.

With execution momentum across all businesses and expanded capacity through acquisitions in the U.S. by Syngene and Biocon Generics, we are well-positioned to drive long-term value creation in FY26 and beyond.” – Kiran Mazumdar-Shaw, Chairperson, Biocon Group.

BIOCON GENERICS

“The generics business’ performance in the first quarter was in line with expectations, delivering a 6% revenue growth over the previous year. Growth in the quarter was primarily driven by revenues from recent drug product launches, including Liraglutide in the E.U., and Dasatinib and Lenalidomide in the U.S., supported by higher volumes in our API business. The sequential financial performance reflects the one-time positive impact of Lenalidomide launch quantities in Q4FY25. The capitalization of new manufacturing facilities in the previous fiscal impacted margins.

We remain focused on launching new products, including the commercialization of Liraglutide across key strategic markets.” – Siddharth Mittal, CEO & Managing Director, Biocon Limited.

BIOCON BIOLOGICS

Biocon Biologics started FY26 on a strong footing, delivering 18% year-on-year revenue growth, driven by robust demand across key markets. EBITDA rose 36% Y-o-Y on a like-to-like basis to Rs 645 crore, with a 300 bps sequential margin improvement, driven by improved operating leverage.

The U.S. FDA approval of Kirsty™ (bAspart) builds on the strong foundation established with Semglee® (bInsulin Glargine), enabling us to offer patients the full range of affordable short and long-acting insulin therapies. With regulatory approvals for our bDenosumab products — Vevzuo® and Efraxy® — in Europe and the UK, Biocon Biologics now has 12 approved biosimilar molecules globally. The launch of Yesafili® (bAflibercept) in Canada marked our entry into ophthalmology and the successful commercialization of our 10th biosimilar globally.

As we enter the ‘Accelerate’ phase, we are confident in our ability to scale, deepen market presence, and deliver sustained growth.” – Shreehas Tambe, CEO & Managing Director, Biocon Biologics Limited.

SYNGENE

“We delivered a strong first-quarter performance in line with expectations, with revenue from operations growing 11% year-on-year to Rs 875 crore and EBITDA at Rs 224 crore, reporting a growth of 19%. Growth was driven by continued momentum in Research Services, as pilot programs transitioned into long-term contracts. In Biologics manufacturing, operations have commenced at our Unit III facility in Bengaluru, and preparations are advancing for the Bayview facility in the U.S., scheduled to launch later this year. With a positive first quarter start and strategic investments in scientific capabilities, we remain confident in our ability to deliver on our guidance for the year.” –Peter Bains, CEO & Managing Director, Syngene International Limited.

FINANCIAL HIGHLIGHTS (CONSOLIDATED): Q1FY26

In Rs Crore

| Particulars | Q1FY26 | Q1FY25 | YoY (%) |

| INCOME | |||

| Generics | 697 | 659 | 6 |

| Biosimilars | 2,458 | 2,083 | 18 |

| CRDMO/ Research Services | 875 | 790 | 11 |

| Inter-segment | (87) | (99) | (13) |

| Revenue from operations# | 3,942 | 3433 | 15 |

| Other income@ | 80 | 1,134 | (93) |

| Total Revenue | 4,022 | 4,567 | 151 |

| Net R&D Expenses | 205 | 228 | (10) |

| EBITDA | 829 | 1,755 | 191 |

| EBITDA Margins | 21% | 38% | |

| Core EBITDA$ | 1,003 | 903 | 11 |

| Core EBITDA Margins | 25% | 26% | |

| PBT (before Exceptional Items^) | 97 | 1,114 | 721 |

| PBT | 97 | 1,146 | |

| Net Profit (before Exceptional Items) | 31 | 648 | 3421 |

| Net Profit (Reported) | 31 | 660 | 651 |

Figures above are rounded off to the nearest Crore; % based on absolute numbers.

Notes to financials above:

#Revenue from operations includes licensing income

@Other Income in Q1 FY25 includes BFI divestment gain of Rs1,057 Cr

$Core EBITDA is EBITDA net of R&D expense, licensing, forex, BFI divestment gain, and mark-to-market movement on investments

^Exceptional items during Q1 FY25 amount to Rs 32 crore

1On a like-for-like basis when excluding BFI divestment gain in Q1 FY25

Financial Commentary: Q1FY26

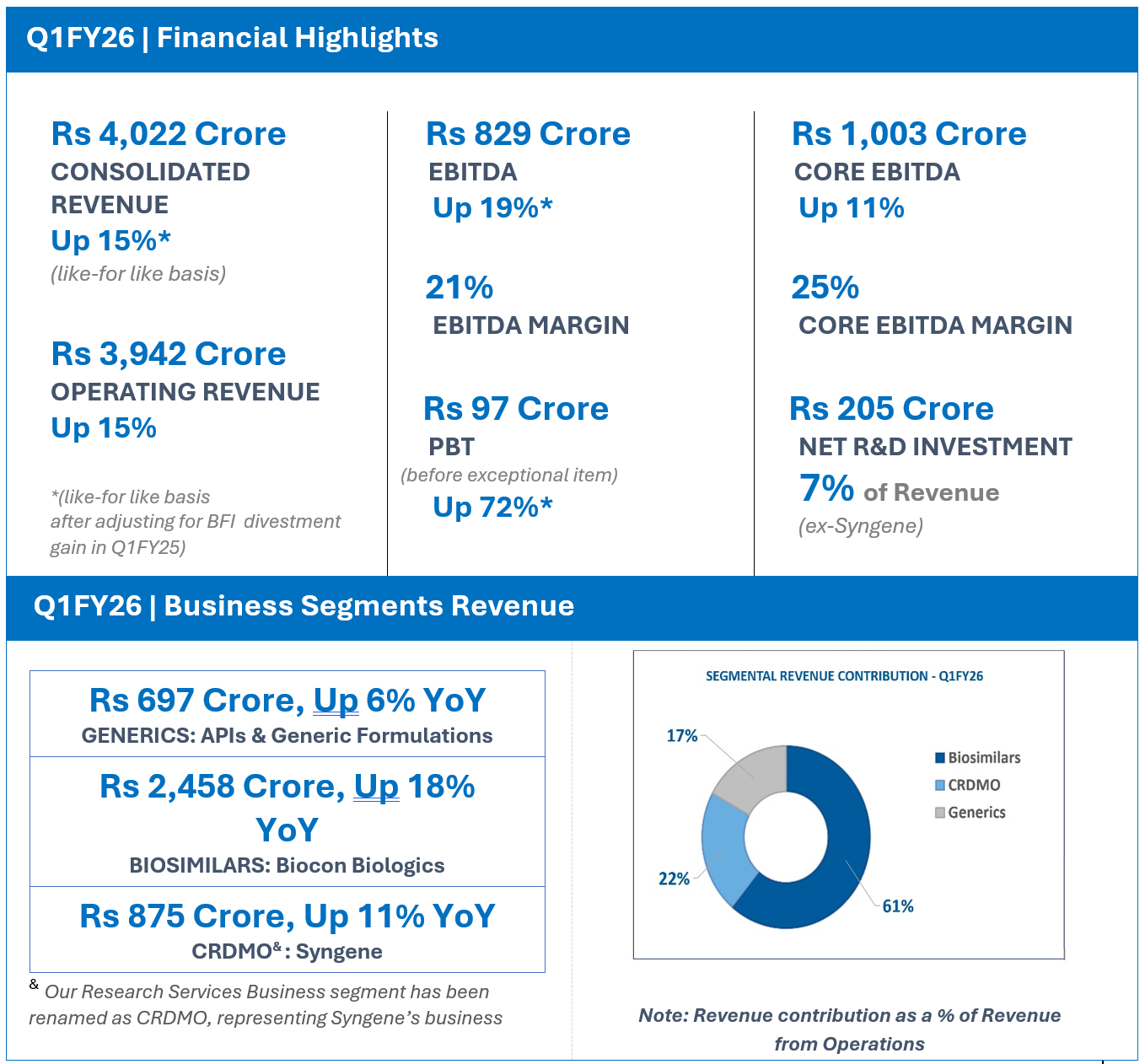

Operating Revenue for Q1FY26 grew 15% year-on-year (YoY) to Rs 3,942 crore.

Core EBITDA at Rs 1,003 crore, grew 11% with core operating margins of 25%.

Net R&D investments for the quarter were Rs 205 crore, representing 7% of revenue ex-Syngene.

EBITDA for the quarter at Rs 829 crore, grew* by 19 % with an EBITDA margin of 21% on a like for like basis.

Profit Before Tax before exceptional items stood at Rs 97 crore, an increase* of 72% on a like for like basis

Net Profit for the quarter, before exceptional items, stood at Rs 31 crore with a growth* of 342% on a like for like basis.

Reported Net Profit for the quarter stood at Rs 31 crore, up* 65% on a like for like basis.

*Excluding BFI divestment gain

Corporate Highlights

Biocon successfully concluded its first equity fundraise since the 2004 IPO, raising Rs 4,500 crores through a well-received Qualified Institutions Placement (QIP) in June 2025. The issue saw strong participation from a diverse set of domestic and global investors reflecting their confidence in our growth trajectory and strategic vision. These funds will be used to increase Biocon’s holding in Biocon Biologics and provide an exit to the private equity investors in Biocon Biologics.

Management Update

Biocon Biologics

Deepali Naair has joined Biocon Biologics as the Global Head of Brand and Corporate Communications and is a member of the Executive Leadership Team. She brings 30+ years of leadership experience in marketing and corporate reputation management across diverse sectors in India, ASEAN, and Australia. Her appointment strengthens Biocon Biologics’ brand and communications function as the company scales its global presence and deepens stakeholder engagement across geographies.

Sustainability

Biocon Limited

Biocon was awarded a gold rating in EcoVadis Corporate Sustainability Assessment, with a score of 77, placing the Company in the top five percentile of organizations assessed worldwide. This is the highest score achieved by the Company and marks a significant milestone in our sustainability journey.

Syngene

Syngene was recognised by TIME magazine and Statista as one of the World’s Most Sustainable Companies in 2025. Syngene ranked #1 in India among companies in the pharma and biotech sectors and was ranked in the top 20 life sciences companies globally.

Business Highlights

GENERICS: APIs & Generic Formulations

- Q1 FY26 Revenue from Operations at Rs 697 Crore, up 6% YoY

- Q1FY26 R&D Investment was Rs 70 crore, accounting for 10% of Revenue

Business Performance

In the U.S., the Company launched its injectable drug product, Micafungin, an echinocandin anti-fungal medication that treats and prevents a range of fungal or yeast infections, and Everolimus (Zortress®) tablets used to prevent kidney and liver transplant rejection.

In India, approval for Liraglutide (gVictoza) was obtained under the Government of India’s recently introduced ‘Reliance on Recognized Regulatory Authorities’ framework, that recognizes approvals granted by established and well-referenced stringent regulatory authorities. This marks the Company’s first approval in India for its vertically integrated GLP-1 drug product. The Company is preparing to launch the product through its commercialization partners.

The Company obtained final approval for Rivaroxaban tablets in the U.S., used to treat deep vein thrombosis in adults.

The Company’s injectable manufacturing facility primarily focused on GLP-1s in Bangalore has been commissioned with commercialization expected in FY27. The facility will fulfil the business’ portfolio needs across vials, cartridges, pre-filled syringes and drug-device combination products, strengthening its capacity to serve its portfolio demands globally.

Regulatory Inspections

ANVISA, Brazil, recently completed regulatory audits at the Company’s three API sites in Visakhapatnam (sites 5 and 6) and Bengaluru (site 1) with zero observations.

The Company’s oral solid dosage facility in Bengaluru underwent an EU-GMP inspection by the Malta Medicines Authority with one major observation, for which a response has been submitted.

BIOSIMILARS: Biocon Biologics

- Q1FY26 Revenue from Operations at Rs 2,458 Crore, Up 18% YoY

- Q1FY26 EBITDA was Rs 645 Crore; Representing EBITDA Margin of 26%

- Q1FY26 R&D Investments was Rs 134 Crore, Accounting for 5% of Revenue

- Served 6.0+ Million Patients (MAT June 2025 basis)##

##12-month moving annual patient population (June 2024 to July 2025)

Business Performance

Biosimilars revenue from operations for Q1FY26 stood at Rs 2,458 crore, an 18% YoY increase, driven by robust demand for our products across geographies. This growth in revenue translated into an EBITDA at Rs 645 crore representing growth of 36% over last year, on like-to-like basis.

EBITDA margin for Q1FY26 stood at 26%, on a like-for-like basis. EBITDA margins excluding forex and other items stood at 24%, with ~300 bps YoY expansion, representing improvement in operating leverage, as we begin to realize the benefits of economies of scale.

The company continues to expand access to its products with 19 approvals and 19 launches globally.

Advanced Markets

Launches and Commercial Performance

North America

Yesafili™ was launched in Canada, as the first biosimilar Aflibercept in the market. This marks Biocon Biologics’ 10th biosimilar to be commercialized globally. In the U.S., Yesintek™ has emerged as an early leader in the immunology space with significant new prescription shares and a strong formulary coverage with large commercial payors. Our oncology portfolio driven by Ogivri® (bTrastuzumab) and Fulphila® (bPegfilgrastim) continued to see a strong demand.

Europe

In Europe, the company is expanding its footprint and launching new products across the region. Yesintek™ was launched in key European countries. Ogivri® and Abevmy® achieved market shares of 21% and 15%, respectively.

JANZ

In Japan, Ustekinumab BS Subcutaneous Injection [YD] was launched by its strategic partner Yoshindo Inc. Nepexto®, a biosimilar to Enbrel® (Etanercept), was launched in Australia through its local partner Generic Health.

Regulatory Approvals

North America:

In the U.S., Biocon Biologics achieved an important milestone with FDA approval for Kirsty™, a biosimilar to NovoLog® (Insulin Aspart). It is the first and only interchangeable rapid acting biosimilar Insulin to be approved. Kirsty builds on the strong foundation laid by Semglee®, the long-acting insulin analogue and augments the Company’s leadership in the Insulins segment in the U.S.

Europe:

Yesafili™ (bAflibercept) received a positive opinion from the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) for its pre-filled syringe (PFS) presentation. Yesintek™ (bUstekinumab) received marketing authorization from the UK’s Medicines and Healthcare products Regulatory Agency (MHRA). Vevzuo® and Evfraxy®, the Company’s biosimilars to Denosumab, were granted marketing authorization by both the European Commission (EC) and MHRA in the UK which marks Biocon Biologics anticipated entry into bone health space.

Emerging Markets

Emerging Markets business remained strong with increased focus on eight high-impact, self-led markets, resulting in a notable increase in revenue contribution in Q1 FY’26 from these markets.

The Company executed 12 launches from its commercialized portfolio across the region. It also secured several strategic regulatory approvals and continued to file new product applications across regions, which will pave the way for future growth. The company won important tenders in several countries across APAC, AFMET, and LATAM.

Note:. The data presented here inter alia volumes, projections, market share, is based solely on Biocon Biologics’ study, interpretation and conclusion derived through analysis of different data sets from varied sources inter alia IQVIA Q1 CY2025.

–All trademarks, registered or unregistered, are the property of their respective owners.

Contract Research Development & Manufacturing Organization& (CRDMO):

Syngene

- Q1FY26 Revenue from Operations at Rs 875 Crore, Up 11% YoY

- Q1FY26 EBITDA was Rs 224 Crore; Up 19% YoY

Business Performance

Our CRDMO business reported a positive start to FY26 with revenue from operations growing 11% year-on-year to Rs 875 crore and EBITDA rising 19%. Growth was primarily driven by the continued conversion of pilot programs into long-term contracts within the Research Services business. The Company also expanded its scientific platform by commissioning a new, state-of-the-art peptide laboratory—strengthening its capabilities across emerging therapeutic modalities such as monoclonal antibodies, ADCs, oligonucleotides, and PROTACs.

The company successfully completed a USFDA Good Clinical Practices (GCP) inspection of its Human Pharmacology Unit with no observations. The Company’s Biologics facility at Biocon Park received an Establishment Inspection Report (EIR) with a favourable Voluntary Action Indicated (VAI) outcome.

Note: & Biocon has renamed its Research Services business segment as CRDMO to represent Syngene’s business model of a CRO +CMO.

About Biocon Limited

Biocon Limited, publicly listed in 2004, (BSE code: 532523, NSE Id: BIOCON, ISIN Id: INE376G01013) is an innovation-led global biopharmaceuticals company committed to enhance affordable access to complex therapies for chronic conditions like diabetes, cancer and autoimmune. It has developed and commercialized novel biologics, biosimilars, and complex small molecule APIs in India and several key global markets as well as Generic Formulations in the U.S., Europe & key emerging markets. It also has a pipeline of promising novel assets in immunotherapy under development. Website: www.biocon.com Follow-us on X (formerly Twitter) @bioconlimited and LinkedIn: @BioconLimited for company updates. For FY25 Integrated Annual Report of Biocon click here

Biocon Biologics Limited, a subsidiary of Biocon Limited, is a unique, fully integrated, global biosimilars company committed to transforming healthcare and transforming lives. It is capitalizing on its ‘lab to market’ capabilities to serve over 6 million patients across 120+ countries by enabling affordable access to high quality biosimilars. The Company is leveraging cutting-edge science, innovative tech platforms, global scale manufacturing capabilities and world-class quality systems to lower costs of biological therapeutics while improving healthcare outcomes.

Biocon Biologics has commercialized 10 biosimilars from its portfolio which are addressing the patients’ needs in key emerging markets and advanced markets like U.S., Europe, Australia, Canada, and Japan. It has a pipeline of 20 biosimilar assets across diabetology, oncology, immunology, ophthalmology, bone health and other non-communicable diseases. The Company has many ‘firsts’ to its credit in the biosimilars industry. As part of its environmental, social and governance (ESG) commitment, it is advancing the health of patients, people, and the planet to achieve key UN Sustainable Development Goals (SDGs). Website: www.bioconbiologics.com; Follow us on X (formerly Twitter): @BioconBiologics and LinkedIn: Biocon Biologics for company updates.

Syngene International Ltd.

(BSE: 539268, NSE: SYNGENE, ISIN: INE 398R01022) is an integrated research, development, and manufacturing services company serving the global pharmaceutical, biotechnology, nutrition, animal health, consumer goods, and specialty chemical sectors. Syngene’s more than 5600 scientists offer both skills and the capacity to deliver great science, robust data security, and world class manufacturing, at speed, to improve time-to-market and lower the cost of innovation. With a combination of dedicated research facilities for Amgen, Baxter, and Bristol-Myers Squibb as well as 2.2 Mn sq. ft of specialist discovery, development, and manufacturing facilities, Syngene works with biotech companies pursuing leading-edge science as well as multinationals, including GSK, Zoetis and Merck KGaA. For more details, visit www.syngeneintl.com For the Company’s FY24 Environmental, Social, and Governance (ESG) report, visit https://esgreport.syngeneintl.com/