Leadership Comments

BIOCON GROUP

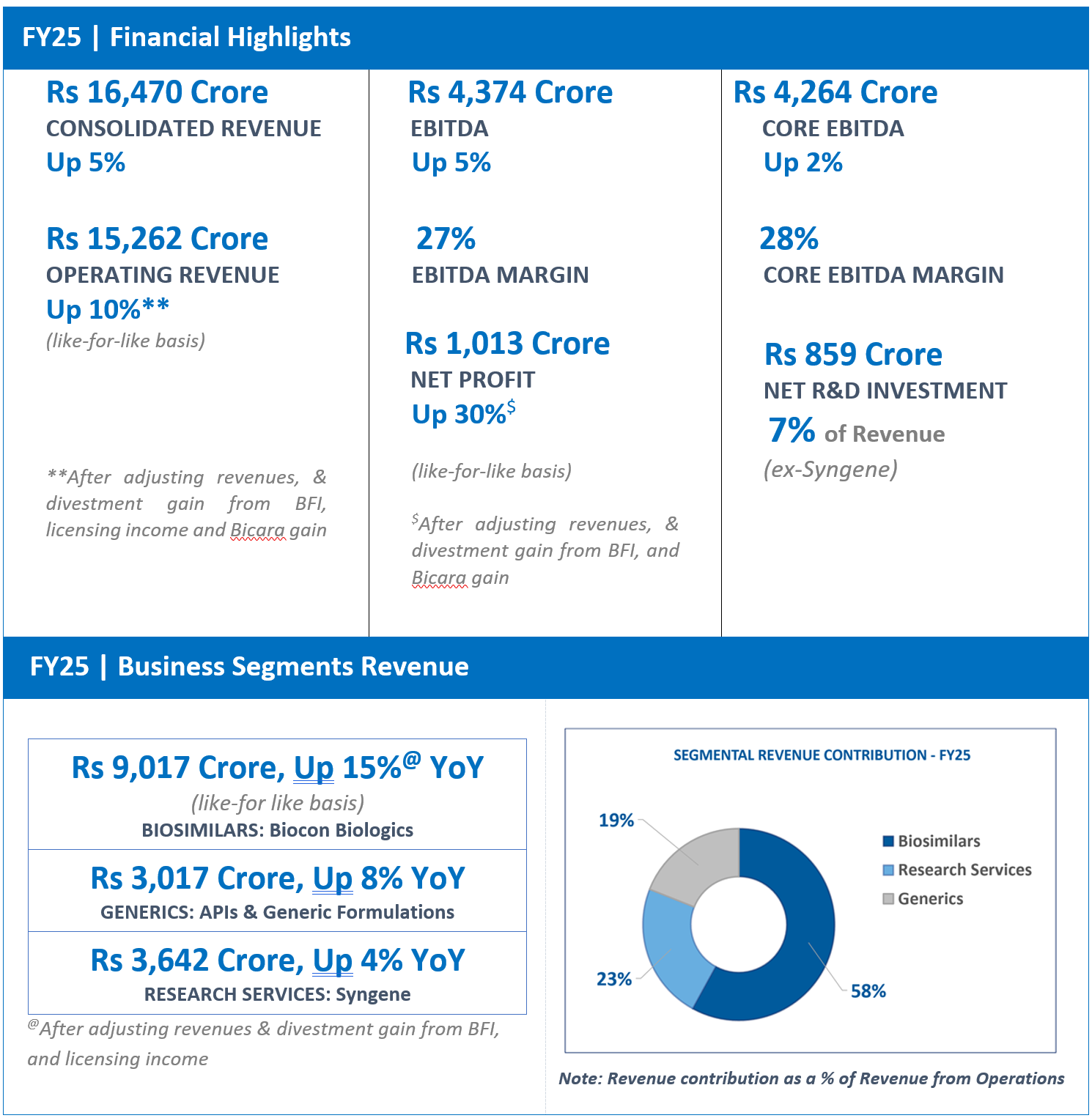

“The Biocon Group ended the year with a strong performance across its businesses. The launch of Liraglutide in the UK market heralded our entry into the GLP-1 therapy segment. Our Biosimilars continue to build impressive shares in global markets with four biosimilars recording sales of USD 200 million each in FY25. We also launched our fifth biosimilar product Yesintek™ (bUstekinumab) in the U.S. market. This quarter marked the expansion of Syngene’s biologics manufacturing footprint through an acquisition of a state-of-the-art manufacturing facility in the U.S.

“FY25 has been a year of consolidation and transition. We are now on a path of accelerating growth with a commitment to innovation, digital augmentation and operational excellence.”

— Kiran Mazumdar-Shaw, Chairperson, Biocon Group.

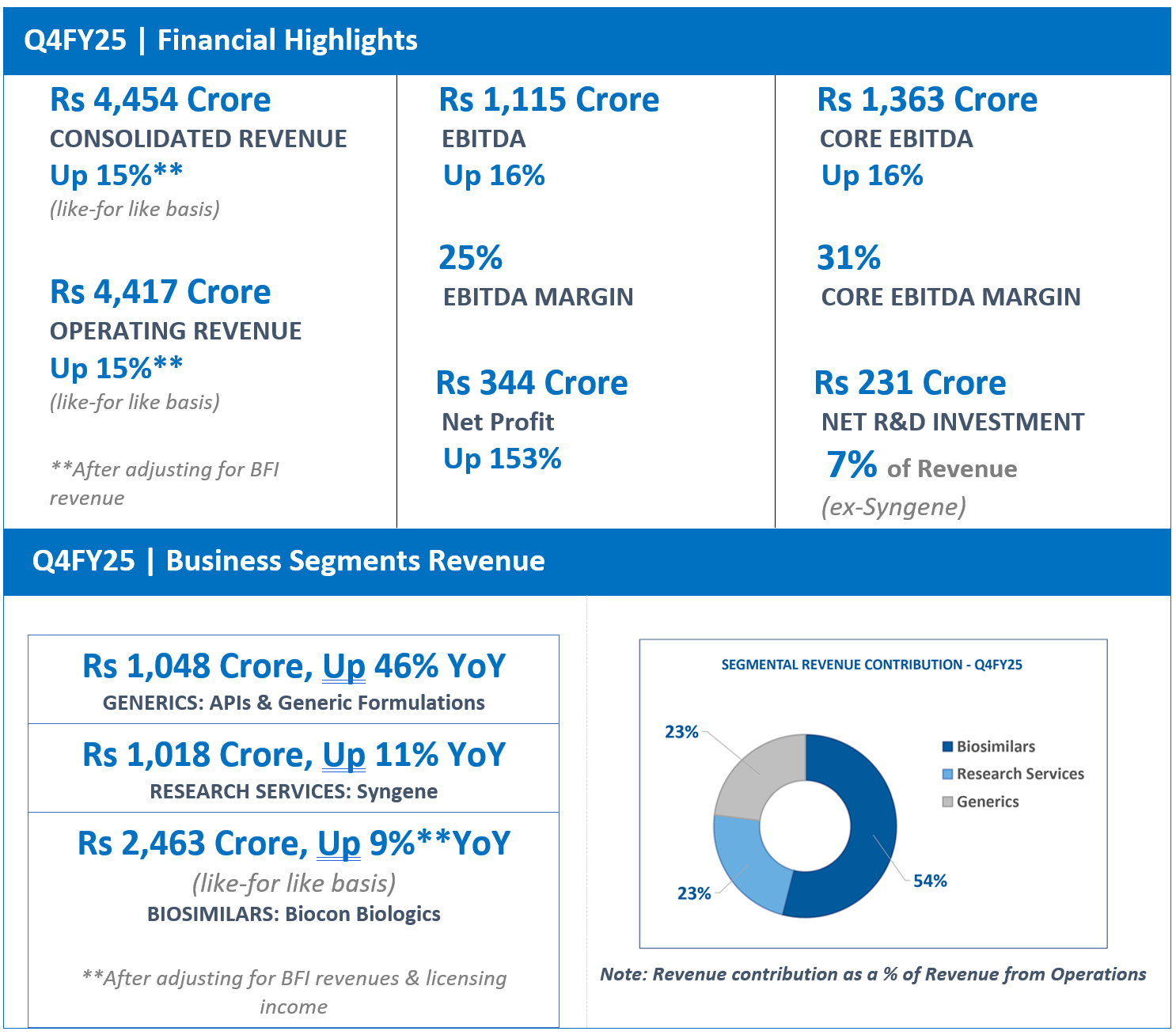

BIOCON GENERICS

“The Generics business delivered a healthy 46% YoY and a robust 53% sequential growth in Q4, concluding FY25 with an overall 8% growth over the previous year. The performance was primarily driven by contributions from new product launches, notably Lenalidomide and Dasatinib in the U.S., supported by modest growth in our API business.

“Looking ahead, we remain focused on the strategic expansion of our differentiated GLP-1 portfolio into new markets, which will position us well for growth. In FY26, we also expect to see a recovery in the API business, aided by our cost improvement initiatives, enhancement of operational efficiencies, and new capacities coming on-stream.”

— Siddharth Mittal, CEO & Managing Director, Biocon Limited.

BIOCON BIOLOGICS

“Biocon Biologics continued its growth momentum in Q4FY25, delivering a robust 9% year-on-year revenue increase driven by significant market share gains in the U.S. and key tender wins in Emerging Markets. Regulatory approvals of our manufacturing facilities from USFDA and EMA have enabled the launch of Yesintek™️, our bUstekinumab, in the U.S. and Europe. The successful settlement of our patent litigation has allowed us to secure a market entry date for Yesafili™️, our bAflibercept, in the U.S.

“On a full-year basis, the Company has recorded a strong 15% growth in FY25 and we have successfully consolidated our business worldwide. Having built a strong foundation, we are well positioned to launch 5 new products in the next 12-18 months and expand patient access.”

— Shreehas Tambe, CEO & Managing Director, Biocon Biologics Limited.

SYNGENE

“Syngene reported Q4FY25 revenue growth of 11% year-on-year, and 8% sequentially, crossing the Rs. 1,000 Crore in a quarter threshold for the first time. At the EBITDA level, growth was 9% YoY reflecting good underlying fundamentals. The full year results, led by reported revenue growth of 4%, are in line with our earlier guidance, reflecting a resilient performance in a challenging year marked by a sectoral downturn in U.S. biotech funding. We continued to make strategic investments to enhance our capabilities and capacities across business while maintaining a strong balance sheet and an improved net cash position.

“Looking at the year ahead, while the wider global market dynamics remain uncertain, the positive momentum that drove Syngene’s return to growth in the latter half of FY25 is expected to continue into FY26, with projected revenue growth in the mid-single digits.”

—Peter Bains, CEO & Managing Director, Syngene International Limited.