Bengaluru, Karnataka, India: January 21, 2021:

Biocon Ltd (BSE code: 532523, NSE: BIOCON), an innovation-led global biopharmaceuticals company, today announced its consolidated financial results for the fiscal third quarter ended December 31, 2020.

Commenting on the results, Kiran Mazumdar-Shaw, Executive Chairperson, Biocon, said:

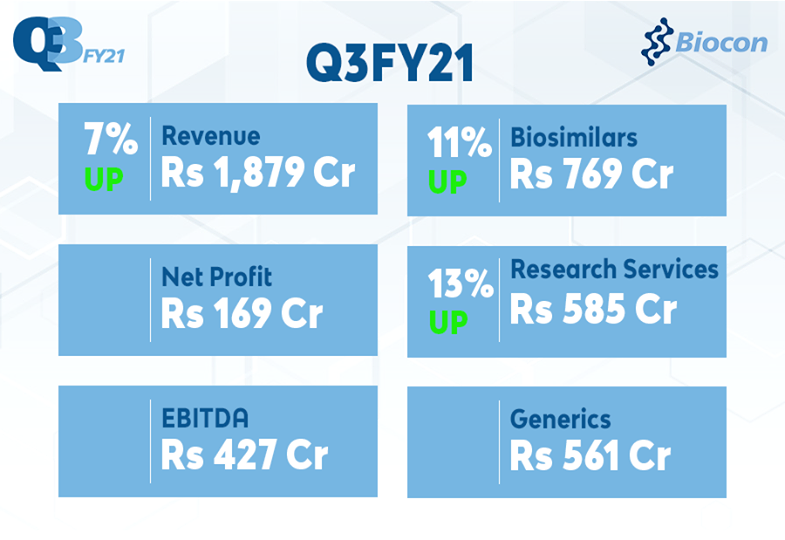

“Consolidated revenue for Q3FY21 increased 7% year on year to ₹1,879 Crore driven by 13% growth in Research Services, and 11% in Biosimilar business segments. EBITDA for the quarter stood at ₹427 Crore and Net Profit was at ₹169 Crore. Our Core EBITDA margins stood at 31%.

“The two recent investments of USD 225 million in Biocon Biologics by Goldman Sachs and ADQ[1] endorse the value creation of our biosimilars business. These investments augur well for our business and will enable us to invest in expanding our research and manufacturing capacities across segments. The recent launch of Tacrolimus capsules in the US, as well as approvals in Most of the World (MoW) markets for Insulin Aspart, Bevacizumab and Trastuzumab biosimilars will also pave the way for expanding our business in future.”

“2020 has been one of the most challenging years for the world with an unprecedented pandemic impact on the global economy. We continue to face headwinds across operational, regulatory and commercial functions which have been deterrents to our planned market expansion. However, we expect normalization by next fiscal,” she added

PERFORMANCE REVIEW: Q3FY21

- Q3FY21 Consolidated Revenue grew 7% to ₹1,879 Crore (vs ₹1,753 Crore in Q3FY20)

- Q3FY21 Earnings before Interest, Depreciation and Amortization (EBITDA) at ₹427 Crore (vs ₹480 Crore in Q3FY20)

- Q3FY21 Net Profit (before exceptional item and discontinuing operations) at ₹169 Crore (vs ₹206 Crore in Q3FY20)

- Q3FY21 Net Profit at ₹169 Crore (vs ₹203 Crore in Q3FY20)

- Core EBITDA margins were at 31%

Q3FY21 FINANCIAL HIGHLIGHTS (CONSOLIDATED)

In ₹ Crore

| Particulars | Q3FY21 | Q3FY20 | YoY% |

| INCOME | |||

| Generics | 561 | 576 | (3%) |

| Biosimilars | 769 | 693 | 11% |

| Novel Biologics | – | – | – |

| Research Services | 585 | 519 | 13% |

| Inter-segment | (63) | (71) | (12%) |

| Revenue from Operations# | 1,851 | 1,717 | 8% |

| Other Income | 28 | 36 | (22%) |

| TOTAL REVENUE | 1,879 | 1,753 | 7% |

| EBITDA | 427 | 480 | (11%) |

| PBT (before exceptional item) | 236 | 318 | (26%) |

| Net Profit (before exceptional item and discontinuing operation) | 169 | 206 | (18%) |

| Loss from discontinuing operation | 1 | 3 | (75%) |

| Net Profit | 169 | 203 | (17%) |

| R&D Expenses in P&L | 171 | 131 | 30% |

| Gross R&D Spends | 183 | 155 | 18% |

| EBITDA Margin | 23% | 27% | |

| Core EBITDA Margin | 31% | 34% | |

| Net Profit Margin | 9% | 12% | |

| #includes Licensing Income. All Figures above are rounded off to the nearest Crore; % based on absolute numbers. | |||

Biocon Biologics Limited : Board Announcements:

Prof Peter Piot, MD, PhD, Director of the London School of Hygiene & Tropical Medicine and the Handa Professor of Global Health, has joined the Board of Biocon Biologics Limited. He has been appointed as an Independent Director for a period of three years starting January 21, 2021. He brings years of scientific expertise, long experience in public health interventions and policy framing on major health issues. His thought leadership and invaluable experience in global healthcare will further enable Biocon Biologics to become an innovative global leader in biosimilars committed to delivering affordable access to life saving Biologics.

Pursuant to a mutual agreement, Dr. Christiane Hamacher, has stepped down as the Managing Director of Biocon Biologics Limited, a subsidiary of Biocon Limited, and has also ceased to be a member of the Board of Directors of Biocon Biologics Limited, effective 20th January, 2021. This decision was taken due to professional differences with the Chairperson on strategic priorities and vision for the Company. Her last working day as CEO would be February 28, 2021. Dr Christiane Hamacher has played an important role in the growth of the business over the past couple of years with earnest business acumen. The company thanks her for her contributions and wishes her the best for her future endeavours.

Pursuant to this development, Dr Arun Chandavarkar, member of the board of Biocon Biologics Limited will take over the mantle of Managing Director, effective Jan 21, 2021, for a period of up to two years, and Ms Kiran Mazumdar Shaw will be the Executive Chairperson of Biocon Biologics Limited effective from Jan 21, 2021 until March 31, 2022.

BUSINESS SEGMENT REVIEW

BIOSIMILARS: Biocon Biologics

Highlights:

- Q3FY21 revenue at ₹769 Crore, up 11% YoY and 14% QoQ

- EBITDA margins at 27%

- 9MFY21 revenue at ₹2,137 Crore, up 14% YoY

- Patients benefited in Q3FY21 on MAT basis (Jan – Dec 2020): 3.2 million

Regulatory & Clinical

- Biosimilars Bevacizumab* and Insulin Aspart* approved by National Pharmaceutical Regulatory Agency (NPRA), Malaysia.

- Biosimilars Trastuzumab* and Insulin Glargine* approved in 2 additional MoW countries.

- European Medicines Agency’s CHMP recommended approval of our biosimilar Insulin Aspart* to treat Type 1 and 2 diabetes.

- US FDA deferred action on Biologics License Application (BLA) for biosimilar Bevacizumab* citing the inability to inspect our facility due to COVID-19-related travel restrictions.

- Our BLA for Insulin Aspart* is also under review by the US FDA.

- Over 100 patients, out of a total of 300, have been enrolled in Phase 4 clinical studies for Itolizumab in treating CRS (cytokine release syndrome) in moderate to severe ARDS (acute respiratory distress syndrome) due to COVID-19.

Value Unlocking

- Abu Dhabi-based ADQ[1] committed to invest ₹555 Crore (USD 75 million) for a 1.80% minority stake, valuing Biocon Biologics at ~USD 4.17 billion.

- Goldman Sachs made a capital injection of USD 150 million in exchange for Optionally Convertible Debentures of Biocon Biologics.

*Partnered with Viatris

Commenting on the Q3 FY21 performance, Dr Christiane Hamacher, CEO, Biocon Biologics Ltd, said,

“We have reported a topline of ₹769 Crore for Q3FY21, representing a growth of 11% versus Q3FY20 and 14% versus Q2FY21. We continue to maintain a steady market share for bTrastuzumab and bPegfilgrastim in the US despite a tough environment, while our insulins and mAbs portfolios in key MoW markets continue to do well. In Malaysia, we received a one-year extension of our Off-Take Agreement (OTA) for insulins and we also received NPRA approvals for bInsulin Aspart and bBevacizumab. Despite various operational and commercial challenges, we are ensuring that we continue to address patients’ needs for high quality biosimilars across diverse markets.”

“The additional round of Private Equity (PE) investments this quarter by ADQi and Goldman Sachs reaffirms the confidence investors have in Biocon Biologics’ growth story. So far, we have raised USD 330 million from True North, Tata Capital, Goldman Sachs and ADQi. The valuation of Biocon Biologics has increased by USD 1.2 billion over the last 12 months and currently stands at ~USD 4.17 billion,” she added.

The Biosimilars segment revenue growth this quarter was driven by steady market share of our products in the US and growth in key MoW markets including AFMET and India. Through our partners, we continue to expand sales for rHI (recombinant human insulin) in key markets like Mexico & Malaysia, and Insulin Glargine in Algeria & Malaysia. We continue to be the leading player for biosimilar Trastuzumab in Brazil’s private market and are reporting strong performance in other markets like Turkey & Algeria.

The impact of COVID-19 on our business has been greater than anticipated, and it is restricting our revenue growth. We are experiencing delays in the award of tenders, and higher entry barriers are preventing opening of new markets. With fewer patients visiting hospitals due to uncertainty around COVID-19, we are witnessing an impact in product off-take in critical care segments such as oncology. We are working to mitigate these operational and commercial challenges and are confident of overcoming them by next fiscal.

[1] Agreement between ADQ and Biocon Biologics has been signed. Transaction subject to customary closing conditions

GENERICS: APIs & Formulations

Highlights:

- Q3FY21 revenue at ₹561 Crore, down 3% YoY

- 9MFY21 revenue at ₹1,758 Crore, up 7% YoY

- Tacrolimus capsules, a calcineurin inhibitor used in the treatment of organ transplant patients, launched in the US

- Received our first anti-diabetic DMF approval in China for Sitagliptin API

Commenting on the performance, Siddharth Mittal, CEO & Managing Director, Biocon Limited, said, “The Generics business experienced a subdued performance in Q3 as demand moderated following a period of advance buying by customers in the first half of this fiscal, apprehending supply disruptions in the wake of the pandemic. Growth was also impacted by delays in regulatory approvals of certain products that required physical inspection of our facilities, due to covid related travel restrictions. We achieved an important milestone during the quarter with the launch of Tacrolimus capsules in the US, which reflects our commitment to bring vertically integrated, complex finished dosages to the market.

Looking ahead, as we expand our portfolio and enter new geographies, new product approvals will be a crucial determinant of our growth. We will continue to focus on the advancement of our development pipeline and capacity enhancement projects.”

Other developments

Generics

Our statin formulations portfolio, comprising Rosuvastatin, Atorvastatin and Simvastatin tablets, continue to hold mid to high teens market share in the US, while we have started locking in contracts for Tacrolimus capsules.

In formulations, we also filed one MAA (Marketing Authorization Application) for UK and two Generic dossiers for MoW markets.

We have made progress on entering new geographies with our APIs. We received two Drug Master File (DMF) approvals during the quarter. We also filed 10 DMFs for APIs in the US, Europe and MoW markets.

The Generics business encountered some COVID-19 related headwinds. Our portfolio of statin APIs were impacted because of a muted demand from customers who had stockpiled in Q1, anticipating a pandemic-related supply disruption. Our entry into some critical markets like Japan and Russia have been impacted by COVID-19 related challenges, such as delays in GMP audits.

NOVEL BIOLOGICS

Equillium, our US-based partner, is making steady progress in the Phase 1b clinical trials for Itolizumab in the first-line treatment of acute graft-versus-host disease (aGVHD). The overall Phase 1b topline data is expected during the first half of 2021.

RESEARCH SERVICES: Syngene

Highlights:

- Q3FY21 revenue at ₹585 Crore, up 13% YoY

- 9MFY21 revenue at ₹1,526 Crore, up 9% YoY

- Entered into a collaboration with 3DC (Deerfield Discovery and Development) for providing integrated drug discovery projects, from early target validation to preclinical evaluation; 3DC has awarded four antibody discovery projects to Syngene in areas of oncology and autoimmune diseases

- Expanded Hyderabad facility and added capacity for an additional 90 scientists

Commenting on the performance, Jonathan Hunt, CEO & Managing Director, Syngene said: “The third quarter saw improved growth, in line with our guidance, with sustained performances from all divisions. The key highlight of the quarter was the expansion of the integrated drug discovery platform (IDD) with four new projects from 3DC. This reflects our ability to deliver projects from early discovery to the clinic. We also continue to support the government and local communities in the fight against the COVID-19 pandemic using our scientific expertise and infrastructure.”

Enclosed: Fact Sheet – with Financials as per IND-AS

About Biocon Limited:

Biocon Limited, publicly listed in 2004, (BSE code: 532523, NSE Id: BIOCON, ISIN Id: INE376G01013) is an innovation-led global biopharmaceuticals company committed to enhance affordable access to complex therapies for chronic conditions like diabetes, cancer and autoimmune. It has developed and commercialized novel biologics, biosimilars, and complex small molecule APIs in India and several key global markets as well as generic formulations in the US and Europe. It also has a pipeline of promising novel assets in immunotherapy under development. www.biocon.com Follow-us on Twitter: @bioconlimited

Biocon Biologics Limited, a subsidiary of Biocon Limited is uniquely positioned as a fully integrated ‘pure play’ biosimilars organization in the world. Building on the four pillars of Patients, People, Partners and Business, Biocon Biologics is committed to transforming healthcare and transforming lives. Biocon Biologics is leveraging cutting-edge science, innovative tech platforms and advanced research & development capabilities to lower treatment costs while improving healthcare outcomes. It has a platform of 28 biosimilar molecules across diabetes, oncology, immunology, dermatology, ophthalmology, neurology, rheumatology and inflammatory diseases. Five molecules from Biocon Biologics’ portfolio have been taken from lab to market, of which three have been commercialized in developed markets like United States, EU, Australia, Canada and Japan. With a team of over 4800 people Biocon Biologics aspires to transform healthcare through affordable innovative solutions as well as impact 5 million patients’ lives by FY 22. www.biocon.com/businesses/biosimilars/ Follow-us on Twitter: @BioconBiologics

Earnings Call

The company will conduct a call at 9.00 AM IST on January 22, 2021 where the senior management will discuss the company’s performance and answer questions from participants. To participate in this conference call, please dial the numbers provided below ten minutes ahead of the scheduled start time. The dial-in number for this call is +91 22 6280 1151/+91 22 7115 8052. Other toll numbers are listed in the conference call invite which is posted on the company website www.biocon.com under Investors>>Financial Calendar>>Earnings Call for period ended December 31, 2020. The operator will provide instructions on asking questions before the start of the call. A replay of this call will also be available 60 minutes from the conclusion of the call till January 29, 2021 on +91 22 7194 5757/+91 22 6663 5757, Playback Code: 44824. Transcript of the conference call will be uploaded on the company website in due course.

Forward-Looking Statements: Biocon

This press release may include statements of future expectations and other forward-looking statements based on management’s current expectations and beliefs concerning future developments and their potential effects upon Biocon and its subsidiaries/ associates. These forward-looking statements involve known or unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Important factors that could cause actual results to differ materially from our expectations include, amongst other: general economic and business conditions in India and overseas, our ability to successfully implement our strategy, our research and development efforts, our growth and expansion plans and technological changes, changes in the value of the Rupee and other currency changes, changes in the Indian and international interest rates, change in laws and regulations that apply to the Indian and global biotechnology and pharmaceuticals industries, increasing competition in and the conditions of the Indian and global biotechnology and pharmaceuticals industries, changes in political conditions in India and changes in the foreign exchange control regulations in India. Neither Biocon, nor our Directors, or any of our subsidiaries/associates assume any obligation to update any particular forward-looking statement contained in this release.